Market Meltdown: Analyzing the Latest Crash in Stocks and Crypto

The financial world was shaken on the last trading day as both the stock and cryptocurrency markets experienced a significant downturn. Investors were left reeling as major indices and popular cryptocurrencies plummeted, raising concerns about the stability of global markets. In this blog post, we will delve into the factors that contributed to this dramatic fall, the immediate impacts, and the potential long-term implications for investors and the broader economy.

The Stock Market Crash

The stock market saw a sharp decline, with major indices like the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite all experiencing significant drops. Several factors contributed to this downturn:

- Inflation Concerns: Persistent inflation has been a major concern for investors. Despite central banks’ efforts to control it, rising prices continue to erode consumer purchasing power and corporate profits, leading to market uncertainty.

- Interest Rate Hikes: In response to inflation, central banks around the world have been increasing interest rates. Higher interest rates tend to reduce spending and borrowing, slowing down economic growth. This has led to fears of an impending recession, further spooking investors.

- Geopolitical Tensions: Ongoing geopolitical conflicts, particularly in regions with significant economic influence, have added to market volatility. Uncertainty about global trade and stability has made investors more risk-averse.

- Earnings Reports: Recent earnings reports from major corporations have been mixed, with some falling short of expectations. Disappointing earnings have led to a reassessment of stock valuations, contributing to the market decline.

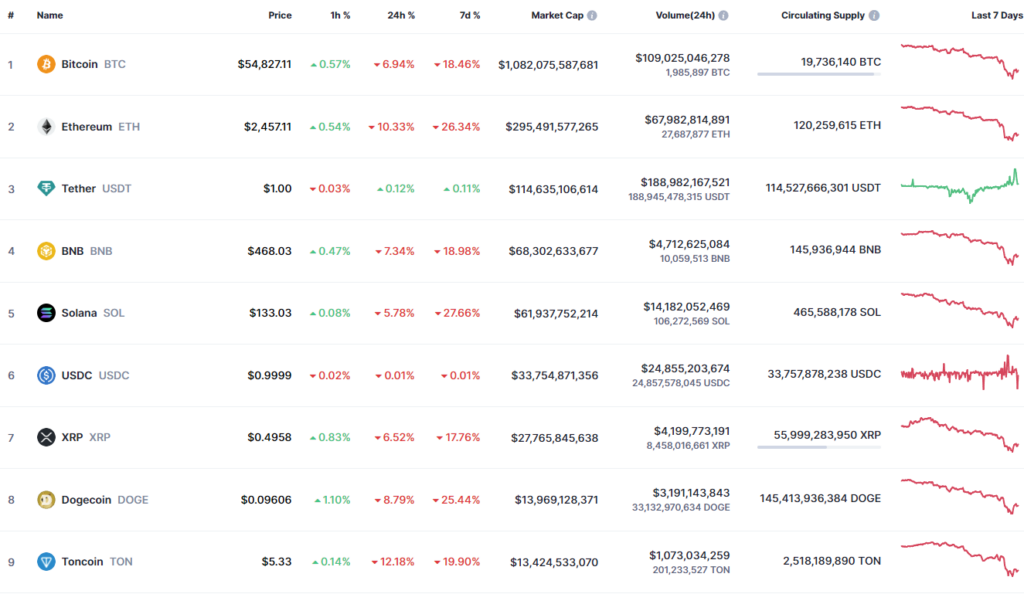

The Cryptocurrency Crash

The cryptocurrency market mirrored the stock market’s performance, with major digital assets like Bitcoin, Ethereum, and others experiencing steep declines. Key factors influencing this crash include:

- Regulatory Pressures: Governments and regulatory bodies worldwide have been increasing scrutiny on the cryptocurrency market. Announcements of potential regulations and crackdowns have created uncertainty and fear among investors.

- Market Sentiment: The crypto market is highly sensitive to market sentiment. Negative news and market speculation can lead to rapid sell-offs, as was seen during the latest crash. The interconnectedness of crypto assets means that a drop in one major asset can trigger declines across the board.

- Technical Factors: The crypto market often experiences significant price movements due to technical trading factors. Large sell orders, liquidation of leveraged positions, and lack of liquidity can amplify price declines.

- Macro-Economic Influences: Similar to the stock market, cryptocurrencies are not immune to broader economic trends. Inflation, interest rate hikes, and geopolitical tensions also impact investor confidence in digital assets.

Immediate Impacts

The immediate impacts of the market downturn have been severe for both individual and institutional investors. Portfolio values have dropped significantly, leading to substantial financial losses. The volatility has also created a challenging environment for traders and could lead to increased market skepticism in the short term.

Long-Term Implications

- Market Correction: Some analysts view the current downturn as a market correction, a natural adjustment following periods of significant gains. This correction could lead to more sustainable growth in the future, once the excesses are flushed out.

- Investment Strategies: Investors may become more cautious and shift towards safer assets, such as bonds or gold. Diversification strategies will likely gain prominence as a way to mitigate risk.

- Regulatory Landscape: The increased regulatory scrutiny on both the stock and crypto markets could lead to more defined regulations. While this might create short-term uncertainty, it could also provide long-term stability and legitimacy, particularly for cryptocurrencies.

- Technological Advancements: Despite the downturn, the underlying technologies of cryptocurrencies and blockchain continue to evolve. Innovations in these areas could drive future market growth and adoption, regardless of current price movements.

Conclusion

The recent crash in the stock and cryptocurrency markets has highlighted the volatility and interconnectedness of global financial systems. While the immediate impacts are challenging, understanding the underlying factors can help investors navigate this turbulent period. As markets adjust and stabilize, opportunities for growth and innovation will likely emerge, shaping the future of finance.